long island real estate market - to sell or hold

by:COSCO

2020-07-04

Many homeowners in Long Island are considering whether to sell the house now or \"Wait a minute \".

I would like to discuss some of the factors that might help with this decision.

These factors also reveal why it is so important to choose a competent realtor.

In the 1999 to 2004/2005 years, the real estate market, especially the Long Island real estate market, realized the value appreciation because the house price may rise by 30% in 12 months.

In this article, I would like to introduce the \"real estate roller coaster \".

This is a chart compiled by some very smart people to track trends in real estate in the past 110.

You can see the roller coaster on Google. com -http:.

Now you have to try to stay with me.

At the end of the roller coaster, you will notice an incredible tilt that will never seem to end.

It is the steepest and longest of the entire roller coaster.

Unfortunately, we are at the end of the slope and are now facing a decline.

The good news is that we are moving slowly.

A simple question to ask a homeowner who is considering selling is, \"How far do you want to go?

\"However, this is not what I want to focus on.

I don\'t want to pay attention to the downward forecast of the real estate market.

Instead, I want to focus on the steep slopes and compare them to the other ones.

Throughout the recorded history, the real estate market generally has a steady appreciation of 4% to 6% per year.

Now, I would like to point out that this standard is applied to today\'s market.

Many homeowners are currently in a situation where they are considering whether to sell their home.

They lost precious time, too. and money)

Did not put their house on the market with the top agency team.

However, some people are also in a situation where they don\'t have to sell. They say to themselves, \"Let\'s wait.

\"Waiting\" is a relative term and I want to build the whole article around this term.

House prices have fallen on Long Island.

So let\'s take a homeowner as an example.

We call him Joe.

Joe owns a house in Smithtown and bought it in 2000 for $245,000.

In January, he put it on the market for $689,000 (

Wow, it appreciated 150% in less than 10 years).

In 2005, if he chose to put it on the market at that time, he might sell it at a reasonable price of $589,000, considering the value of appreciation (

Remember the roller coaster).

The only problem is that Joe didn\'t put it on the market in 2005.

He put it on the market in 2007, but there is the same trend of appreciation.

Joe thinks the roller coaster is still on the rise, in fact, just before the fall of 2005, the roller coaster began to smooth, and by the winter of 2006, the roller coaster began to drop slightly.

Since then, Joe\'s home, like many homeowners on Long Island, has lost \"value\" in his home \".

What we call the \"value\" of equity \"(

The difference between the property owed and the real market value).

So now let\'s say this time by 2007 (December)

Joe ate his lumps.

His real estate agent also overestimated his house in January)

He realized that his house has actually lost value since 2005, and what do you think Joe would do?

What do you think he should do?

We cannot answer this question except to hire me to sell his house.

We need more details.

Joe and his family want to move to North Carolina.

In fact, they \"have to\" because they have purchased a new building house in Lake Norman (

Not in the lake, but by the lake. wink).

This is a very important place for all of us.

It is not the market that causes us trouble;

It is the environment we create in our own lives that causes most of our troubles.

Joe created his own troubles, not the market.

When he put the house on the market for $689,000 in January, his former broker didn\'t help him overprice it, but that\'s life (

Lesson: choose your agent wisely).

So Joe \"needs\" for sale.

For homeowners who don\'t \"need\" to sell, don\'t.

Unless of course you want to, call me in this case (631)587-1700, ext. 51.

Okay, so Joe has to sell.

What he must consider is

In 2005 his house was worth $589,000.

This is what the public who bought the house should pay. market value).

All the houses in his area are now on the market and \"go public\" for about $549,000 \".

Homeowners who are actually \"selling\" their property are accepting prices of about $519,000 or less.

These houses sold in the market for about 195 days (over 6 months)

The original asking price was about $569,000. Pause.

Okay, we\'re going from $689,000 to $519,0000.

Is this a $170,000 market value loss for Joe\'s house? Of course not.

This is the player.

Joe\'s home is never worth $689,000.

On the best day, it was worth $590,000 in 2005.

After 2005, the appreciation of 30% stopped. It vanished.

From January 2006 to March 2007, we lost about 10% of our value.

This is the very bad place for Joe. . . poor Joe.

Since 2007, Joe has lost another 3% to 5% in terms of \"value.

So, at the height of the market, he was in a particular area of Smithtown, and his house was actually worth $590,000.

We will assume that the value is down 14%, which is what the public who purchased will now pay for the house in his area.

That makes Joe pay around $508,000.

So Joe, actually has lost $82,000 since 2005.

Let\'s leave Joe alone (

He needs a break. .

If you have a home now, you are reading the article and taking out the value that you think your home is in 2005, minus 14%.

Now, for all homeowners who don\'t \"need\" to sell their house and plan to \"wait\", let\'s take a look at the roller coaster again.

You will find that the average slope is stable.

Because we \'ve just seen the most significant tilt in real estate history, do you think the roller coaster will bounce right away?

The answer is No.

It will eventually start to pick up and we will assume that the roller coaster is normal.

Therefore, assuming a 5% appreciation, it will take about three years to recover 14% of the housing market value lost throughout Long Island. But wait.

This is where it gets bad (

Sorry for bad luck and Darkness). . .

The market has not yet stabilized.

Long Island homeowners are still losing the market value of their homes as buyers do not buy them.

Not only did they not buy, but many people were unable to buy because of the mortgage difficulties and the overall lack of liquidity in the market (

As investors withdraw large amounts of money, banks do not have enough to lend at interest rates in 2005 (gigantic)

Payment for mortgage loan business).

So, apart from what has been lost, where do we go from here.

Let\'s go back to Joe.

Now he can put his house on the market for $520,000, $29,000 less than his competitors (

Keep in mind that \"listed\" houses in the area are now available for $549,000).

Most realtors, including me, may think that it is an acceptable asking price starting with the fall in house prices.

In fact, the best price for Joe is $508,000, not a penny.

This price will attract the attention of the market.

There are houses in the market now (

As of December 2007)

And it\'s been a long time.

A house in Suffolk County has an average listing time of more than 6 months.

Does Joe want to sit in the market?

No, he wants to sell the house within 3 months.

This is a good broker who comes in and gives Joe nothing but the facts.

Joe think He of house in January of 2007 value 689,000 dollar but in June of 2007 only found he of House fundamental is not worth so much.

Although he\'s been in the last six months

July to December)

Trying to get a price of 2005 (

He has a $590,000 price tag on some items sold by the owner\'s website)

He finally realized that he needed two things.

A good price, a good agent to sell his property.

So now, for those who will stick to the market \"pick up. Five years. That\'s it.

You have to wait 5 years before you can get a 2005 price for your house.

Let me repeat: Get 2005 price in 5 years. Why?

My personal speculative view is this: Assuming that for another 12 months under the current falling market conditions, most homeowners will lose another 5% to 8% of their market value in their houses.

Conservative views).

Similarly, market value is buying something that the public is willing to spend on something --

Anything, whether it\'s a burger, a shirt, a wallet or a house.

Everything sold has \"market value \"(

I didn\'t even talk about the supply and demand factor in this article because it has something to do with the real estate market conditions).

So now remember 14%Add. . . let\'s say 6. 5% (

Mixed rate of decline in market value

I added 5 8, divided by 2 = 6. 5). So 20.

5% is the total estimated loss of Long Island Housing market value.

This is also my personal speculation.

It could be worse or much better.

That is why it is called speculation.

But I will prove my point now.

Is to say that a family, whether it is located, sells for $480,000 in January 20, is now (December 2007)

About $420,000?

The answer is yes. So now minus 6.

$ 5%, $420,000.

Our price is $390,000.

This is a loss of $90,000 or $19. 5%.

So I have a 1% discount.

My point is this is the reality of Long Island family values.

So, in December 2008, we can safely say that the price of all houses across Long Island will be reduced by about 20%.

Assuming that the winter of 2009 began to appreciate by 5%, the winter of 2010, compared with the value of the House in 2005, the market value of the House will lose 15%.

In the winter of 2011, the market value of the House will lose 10% compared with the value of the House in 2005.

In the winter of 2012, compared with the value of the House in 2005, the market value of the House will lose 5%.

In 2013, the House will be in a state of breakeven from the 2005 valuation.

Of course, this is speculative.

But let\'s take a look at some of the quotes and stats that will support it: so, seller, where is it all going to make you?

It depends to a large extent on your situation.

In the business sector, financial transactions are made to obtain the expected profit, based on market research and data.

The housing real estate market is based on the decisions people make for their families, not the almighty dollar.

So my advice to you is to contact me to discuss your options related to the real estate market.

With this information, you can decide what is best for your financial situation and, more importantly, the best for your family\'s future.

I can be (631)587-1700, ext. 51.

If you get anything from this article, please note that there is a trend in the real estate market.

In order to \"wait for the market\", you are looking at a long time

A term of at least four years is pending.

Please understand this and call me if you have any questions.

Keep in mind that you always have a choice regardless of the situation.

If you have financial difficulties, please consult a good lawyer and please do not make decisions based mainly on emotions.

Stay calm, call professionals, get second and third opinions, after getting as much information as possible, then make the most rational decision based on the information.

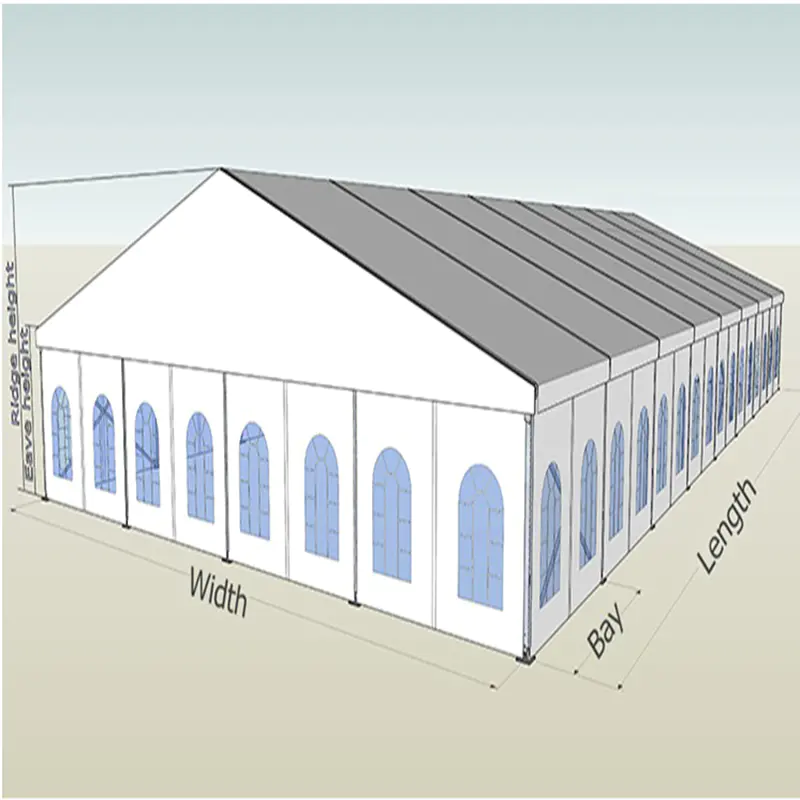

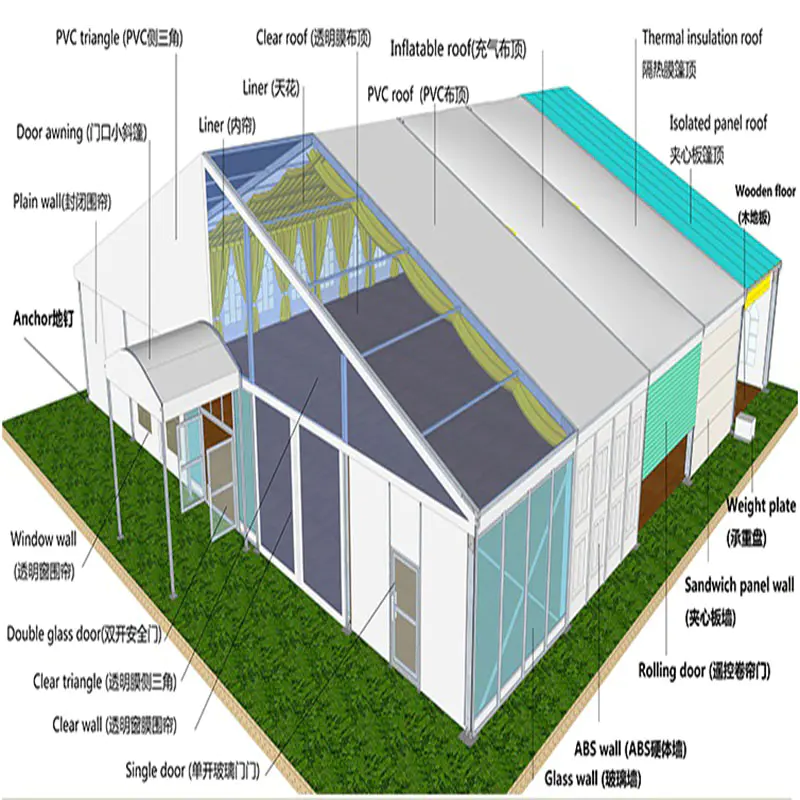

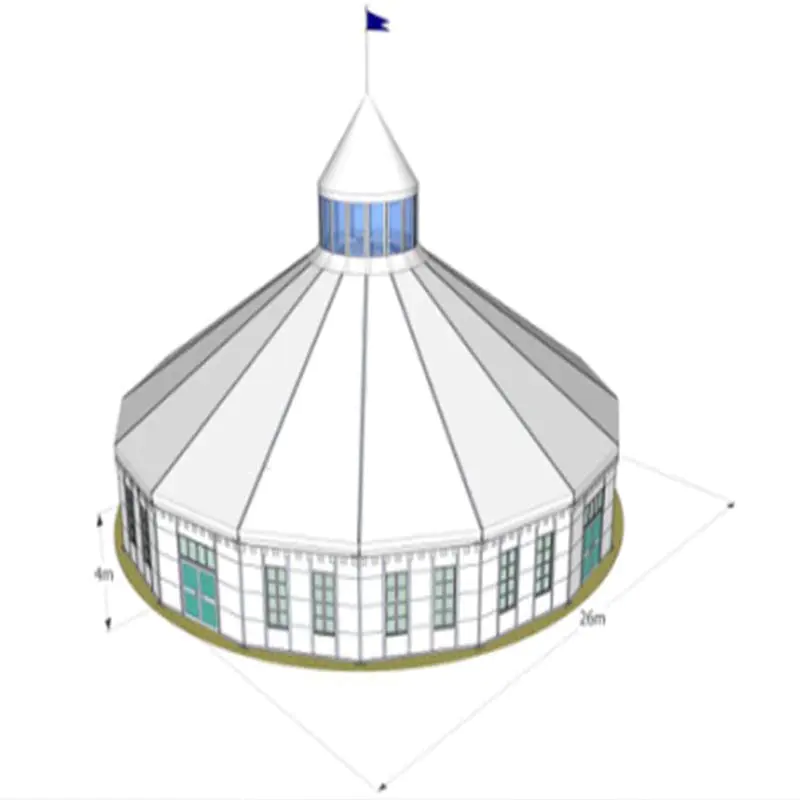

With new and upcoming social commerce technologies, the biggest change for party canopy marketers will be a shift in focus from branding to lead generation and conversion.

If you would like to learn more about event marquee for sale wedding tent, and other types, please be sure to visit COSCO Event Tent. We can offer you top quality as well as cost saving price.

Consistency and simplicity go hand in hand. That means aligning COSCO with the right platforms, speaking to the right customers with the right message, and selling the right idea.

An easy and inexpensive outdoor tents for sale solution can be easily obtained now through purchasing a aluminium tent wedding marquee for sale online. Find your solution at COSCO Event Tent, your demand will be satified.

I would like to discuss some of the factors that might help with this decision.

These factors also reveal why it is so important to choose a competent realtor.

In the 1999 to 2004/2005 years, the real estate market, especially the Long Island real estate market, realized the value appreciation because the house price may rise by 30% in 12 months.

In this article, I would like to introduce the \"real estate roller coaster \".

This is a chart compiled by some very smart people to track trends in real estate in the past 110.

You can see the roller coaster on Google. com -http:.

Now you have to try to stay with me.

At the end of the roller coaster, you will notice an incredible tilt that will never seem to end.

It is the steepest and longest of the entire roller coaster.

Unfortunately, we are at the end of the slope and are now facing a decline.

The good news is that we are moving slowly.

A simple question to ask a homeowner who is considering selling is, \"How far do you want to go?

\"However, this is not what I want to focus on.

I don\'t want to pay attention to the downward forecast of the real estate market.

Instead, I want to focus on the steep slopes and compare them to the other ones.

Throughout the recorded history, the real estate market generally has a steady appreciation of 4% to 6% per year.

Now, I would like to point out that this standard is applied to today\'s market.

Many homeowners are currently in a situation where they are considering whether to sell their home.

They lost precious time, too. and money)

Did not put their house on the market with the top agency team.

However, some people are also in a situation where they don\'t have to sell. They say to themselves, \"Let\'s wait.

\"Waiting\" is a relative term and I want to build the whole article around this term.

House prices have fallen on Long Island.

So let\'s take a homeowner as an example.

We call him Joe.

Joe owns a house in Smithtown and bought it in 2000 for $245,000.

In January, he put it on the market for $689,000 (

Wow, it appreciated 150% in less than 10 years).

In 2005, if he chose to put it on the market at that time, he might sell it at a reasonable price of $589,000, considering the value of appreciation (

Remember the roller coaster).

The only problem is that Joe didn\'t put it on the market in 2005.

He put it on the market in 2007, but there is the same trend of appreciation.

Joe thinks the roller coaster is still on the rise, in fact, just before the fall of 2005, the roller coaster began to smooth, and by the winter of 2006, the roller coaster began to drop slightly.

Since then, Joe\'s home, like many homeowners on Long Island, has lost \"value\" in his home \".

What we call the \"value\" of equity \"(

The difference between the property owed and the real market value).

So now let\'s say this time by 2007 (December)

Joe ate his lumps.

His real estate agent also overestimated his house in January)

He realized that his house has actually lost value since 2005, and what do you think Joe would do?

What do you think he should do?

We cannot answer this question except to hire me to sell his house.

We need more details.

Joe and his family want to move to North Carolina.

In fact, they \"have to\" because they have purchased a new building house in Lake Norman (

Not in the lake, but by the lake. wink).

This is a very important place for all of us.

It is not the market that causes us trouble;

It is the environment we create in our own lives that causes most of our troubles.

Joe created his own troubles, not the market.

When he put the house on the market for $689,000 in January, his former broker didn\'t help him overprice it, but that\'s life (

Lesson: choose your agent wisely).

So Joe \"needs\" for sale.

For homeowners who don\'t \"need\" to sell, don\'t.

Unless of course you want to, call me in this case (631)587-1700, ext. 51.

Okay, so Joe has to sell.

What he must consider is

In 2005 his house was worth $589,000.

This is what the public who bought the house should pay. market value).

All the houses in his area are now on the market and \"go public\" for about $549,000 \".

Homeowners who are actually \"selling\" their property are accepting prices of about $519,000 or less.

These houses sold in the market for about 195 days (over 6 months)

The original asking price was about $569,000. Pause.

Okay, we\'re going from $689,000 to $519,0000.

Is this a $170,000 market value loss for Joe\'s house? Of course not.

This is the player.

Joe\'s home is never worth $689,000.

On the best day, it was worth $590,000 in 2005.

After 2005, the appreciation of 30% stopped. It vanished.

From January 2006 to March 2007, we lost about 10% of our value.

This is the very bad place for Joe. . . poor Joe.

Since 2007, Joe has lost another 3% to 5% in terms of \"value.

So, at the height of the market, he was in a particular area of Smithtown, and his house was actually worth $590,000.

We will assume that the value is down 14%, which is what the public who purchased will now pay for the house in his area.

That makes Joe pay around $508,000.

So Joe, actually has lost $82,000 since 2005.

Let\'s leave Joe alone (

He needs a break. .

If you have a home now, you are reading the article and taking out the value that you think your home is in 2005, minus 14%.

Now, for all homeowners who don\'t \"need\" to sell their house and plan to \"wait\", let\'s take a look at the roller coaster again.

You will find that the average slope is stable.

Because we \'ve just seen the most significant tilt in real estate history, do you think the roller coaster will bounce right away?

The answer is No.

It will eventually start to pick up and we will assume that the roller coaster is normal.

Therefore, assuming a 5% appreciation, it will take about three years to recover 14% of the housing market value lost throughout Long Island. But wait.

This is where it gets bad (

Sorry for bad luck and Darkness). . .

The market has not yet stabilized.

Long Island homeowners are still losing the market value of their homes as buyers do not buy them.

Not only did they not buy, but many people were unable to buy because of the mortgage difficulties and the overall lack of liquidity in the market (

As investors withdraw large amounts of money, banks do not have enough to lend at interest rates in 2005 (gigantic)

Payment for mortgage loan business).

So, apart from what has been lost, where do we go from here.

Let\'s go back to Joe.

Now he can put his house on the market for $520,000, $29,000 less than his competitors (

Keep in mind that \"listed\" houses in the area are now available for $549,000).

Most realtors, including me, may think that it is an acceptable asking price starting with the fall in house prices.

In fact, the best price for Joe is $508,000, not a penny.

This price will attract the attention of the market.

There are houses in the market now (

As of December 2007)

And it\'s been a long time.

A house in Suffolk County has an average listing time of more than 6 months.

Does Joe want to sit in the market?

No, he wants to sell the house within 3 months.

This is a good broker who comes in and gives Joe nothing but the facts.

Joe think He of house in January of 2007 value 689,000 dollar but in June of 2007 only found he of House fundamental is not worth so much.

Although he\'s been in the last six months

July to December)

Trying to get a price of 2005 (

He has a $590,000 price tag on some items sold by the owner\'s website)

He finally realized that he needed two things.

A good price, a good agent to sell his property.

So now, for those who will stick to the market \"pick up. Five years. That\'s it.

You have to wait 5 years before you can get a 2005 price for your house.

Let me repeat: Get 2005 price in 5 years. Why?

My personal speculative view is this: Assuming that for another 12 months under the current falling market conditions, most homeowners will lose another 5% to 8% of their market value in their houses.

Conservative views).

Similarly, market value is buying something that the public is willing to spend on something --

Anything, whether it\'s a burger, a shirt, a wallet or a house.

Everything sold has \"market value \"(

I didn\'t even talk about the supply and demand factor in this article because it has something to do with the real estate market conditions).

So now remember 14%Add. . . let\'s say 6. 5% (

Mixed rate of decline in market value

I added 5 8, divided by 2 = 6. 5). So 20.

5% is the total estimated loss of Long Island Housing market value.

This is also my personal speculation.

It could be worse or much better.

That is why it is called speculation.

But I will prove my point now.

Is to say that a family, whether it is located, sells for $480,000 in January 20, is now (December 2007)

About $420,000?

The answer is yes. So now minus 6.

$ 5%, $420,000.

Our price is $390,000.

This is a loss of $90,000 or $19. 5%.

So I have a 1% discount.

My point is this is the reality of Long Island family values.

So, in December 2008, we can safely say that the price of all houses across Long Island will be reduced by about 20%.

Assuming that the winter of 2009 began to appreciate by 5%, the winter of 2010, compared with the value of the House in 2005, the market value of the House will lose 15%.

In the winter of 2011, the market value of the House will lose 10% compared with the value of the House in 2005.

In the winter of 2012, compared with the value of the House in 2005, the market value of the House will lose 5%.

In 2013, the House will be in a state of breakeven from the 2005 valuation.

Of course, this is speculative.

But let\'s take a look at some of the quotes and stats that will support it: so, seller, where is it all going to make you?

It depends to a large extent on your situation.

In the business sector, financial transactions are made to obtain the expected profit, based on market research and data.

The housing real estate market is based on the decisions people make for their families, not the almighty dollar.

So my advice to you is to contact me to discuss your options related to the real estate market.

With this information, you can decide what is best for your financial situation and, more importantly, the best for your family\'s future.

I can be (631)587-1700, ext. 51.

If you get anything from this article, please note that there is a trend in the real estate market.

In order to \"wait for the market\", you are looking at a long time

A term of at least four years is pending.

Please understand this and call me if you have any questions.

Keep in mind that you always have a choice regardless of the situation.

If you have financial difficulties, please consult a good lawyer and please do not make decisions based mainly on emotions.

Stay calm, call professionals, get second and third opinions, after getting as much information as possible, then make the most rational decision based on the information.

With new and upcoming social commerce technologies, the biggest change for party canopy marketers will be a shift in focus from branding to lead generation and conversion.

If you would like to learn more about event marquee for sale wedding tent, and other types, please be sure to visit COSCO Event Tent. We can offer you top quality as well as cost saving price.

Consistency and simplicity go hand in hand. That means aligning COSCO with the right platforms, speaking to the right customers with the right message, and selling the right idea.

An easy and inexpensive outdoor tents for sale solution can be easily obtained now through purchasing a aluminium tent wedding marquee for sale online. Find your solution at COSCO Event Tent, your demand will be satified.

Custom message